Karnataka Karasamadhana Scheme Apply Online & Registration Form | Karnataka Karasamadhana Scheme Check Timelines & Beneficiary Category | Karnataka Karasamadhana Scheme Check Features & Benefits | Karnataka Karasamadhana Scheme Check Important Points & Documents | Karnataka Karasamadhana Scheme Check Eligibility & All Details |

The Karnataka Karasamadhana Scheme was introduced by the State Government of Karnataka to assist the people in meeting their unpaid water and electricity bills. Individuals who have outstanding bills can pay them off in installments through this program without incurring penalties or facing legal action. The purpose of this program is to help people and motivate them to pay their bills on a regular basis.

Through this article, we will provide you with all types of information about the Karnataka Karasamadhana Scheme 2024 like purpose, Eligibility Criteria, Benefits, Features, important documents, etc. Apart from this, we will share with you the process to apply online for this scheme. To get complete information about this scheme, read this article till the end.

Table of Contents

Karnataka Karasamadhana Scheme

In order to swiftly and without going to court, the Karnataka government introduced the Karnataka Karasamadhana Scheme to collect pre-GST arrears. In July 2023, the Scheme was unveiled, and for those who pay in full by December 31, 2023, 100% of the penalty and interest on tax arrears will be waived. Before the deadline, one can apply online for this scheme.

After submitting an online application for the Karnataka Karasamadhana Scheme, residents of Karnataka will now be able to settle any outstanding debts or bills. The applicant will no longer be eligible to benefit from the Scheme if payment is not received by the deadline. In addition, the Karnataka government offers dealers who want to take part in the Scheme simple application processes.

Highlights Of Karnataka Karasamadhana Scheme

The highlights of this scheme are as follows:-

| Name Of The Scheme | Karnataka Karasamadhana Scheme |

| Launched By | State Government of Karnataka |

| Delegated Ministry | Ministry of Electronics & Information Technology |

| Delegated State | Karnataka |

| Allocated Portal | VAT Portal |

| Objective | To address the issue of many individuals and large corporations |

| Benefit | The residents will be able to pay their pending dues |

| Applicable To | Citizens of Karnataka |

| Beneficiaries | Taxpayers |

| Beneficiary Categories | Applicants who don’t have paid their pending dues |

| Form of Benefit | Facilitation of VAT Submission Portal |

| Hosting Site | National Information Center (NIC) |

| Mode Of Application | Online |

| Last Date To Apply Online | 31st December 2023 |

| Toll-Free No | 18004256300 |

| Official Website | www.vat.kar.nic.in |

Objectives Of Karnataka Karasamadhana Scheme

The major objective of the Karnataka Karasamadhana Scheme is to resolve pre-GST legacy tax disputes and collect back taxes efficiently without resorting to litigation. This program aims to address the issue of many individuals and large corporations failing to pay taxes and interest obligations on time, which negatively impacts India’s economy. This will quickly and easily resolve tax disputes and ensure timely tax collection.

Another objective of launching the Karnataka Karasamadhana Scheme is to solve the problem of people and big businessmen not paying their taxes or interests on time, which in turn affects India’s economy. The scheme aims to replenish pending taxes or interests through new changes made to an existing scheme.

Karnataka Karasamadhana Scheme Timelines

The timelines of this scheme are as follows:-

| Event | Date |

| Case Assessments and Orders Completion | Will be updated soon |

| Tax Arrears Payment Deadline for Scheme Eligibility | Will be updated soon |

Beneficiary Category

It is only on the basis of the beneficiary category that the applicants will be able to gain the benefits of this scheme after getting an online registration. The benefit of this scheme can only be undertaken by the residents of Karnataka state who have not cleared their pending bills.

Application Enrollment and Last Dates

To participate in the Karnataka Karasamadhana Scheme, individuals need to submit their applications within the specified enrollment period. The exact dates for enrollment may vary, so it is important to stay updated with the official announcements from the government. It is advisable to submit the applications well before the deadline to ensure a smooth process.

Selection Procedure

Once the enrollment period is closed, the selection process begins. The government authorities will review the applications and select eligible cases for the Karasamadhana Scheme. The selection is based on various factors, including the nature of the dispute, the willingness of both parties to participate, and the potential for resolution through alternative methods.

Implementation Procedure

After the selection process, the implementation of the Karasamadhana Scheme takes place. The government appoints trained mediators or arbitrators who will facilitate the resolution process. These professionals are experienced in dispute resolution techniques and will work with both parties to find a mutually agreeable solution.

Supervision Body

The Karnataka Karasamadhana Scheme is overseen by a designated supervisory body. This body ensures the smooth functioning of the scheme and monitors the progress of the dispute resolution process. It acts as a neutral third party and ensures that the principles of fairness and justice are upheld throughout the proceedings.

Key Guidelines

Here are some key guidelines to keep in mind while participating in the Karnataka Karasamadhana Scheme:-

- Both parties must be willing to participate voluntarily in the scheme.

- The dispute should fall within the scope of the scheme’s eligibility criteria.

- Confidentiality and privacy of the parties involved will be maintained throughout the process.

- The decision reached through the scheme is binding and enforceable.

- Both parties should cooperate and provide all necessary documents and information required for the resolution process.

- The mediators or arbitrators appointed by the government will act as neutral facilitators and will not take sides.

- Respectful and constructive communication is encouraged during the resolution process.

- The resolution process should be completed within the specified timeframe.

- Any fees or charges associated with the scheme will be communicated to the parties beforehand.

- The decision reached through the scheme is final and cannot be appealed.

Important Instructions

Here are some important instructions to follow while participating in the Karnataka Karasamadhana Scheme:-

- Read and understand the scheme’s guidelines and eligibility criteria before applying.

- Ensure all the necessary documents and information are submitted along with the application.

- Attend the mediation or arbitration sessions as scheduled and actively participate in the resolution process.

- Respect the decisions and recommendations made by the mediators or arbitrators.

- Abide by the confidentiality and privacy rules to maintain the integrity of the process.

- Comply with any additional instructions or requirements communicated by the supervisory body.

- Cooperate with the government authorities and provide any additional information or assistance if requested.

- Keep track of the progress of the dispute resolution process and stay updated with any official communications.

- Notify the authorities if there are any changes in contact information or circumstances during the process.

- Follow the code of conduct and ethical guidelines set by the scheme for all participants.

Tips and Tricks

Here are some tips and tricks to enhance your experience with the Karnataka Karasamadhana Scheme:-

- Prepare yourself by gathering all relevant documents and information related to your dispute.

- Be open-minded and willing to explore alternative solutions to resolve the dispute.

- Communicate clearly and express your concerns and expectations during the resolution process.

- Listen actively and try to understand the other party’s perspective.

- Consider seeking legal advice or consulting a professional mediator before participating in the scheme.

- Stay calm and composed during the sessions, even if emotions run high.

- Take breaks if needed to maintain a clear and focused mindset.

- Document all agreements and decisions reached during the process for future reference.

- Follow up on any actions or commitments agreed upon during the resolution process.

- Reflect on the experience and learn from it to avoid similar disputes in the future.

General Points to Remember

Here are some general points to remember while participating in the Karnataka Karasamadhana Scheme:-

- The scheme aims to provide an efficient and cost-effective alternative to traditional court proceedings.

- Participation in the scheme is voluntary, and both parties must agree to resolve the dispute through alternative methods.

- The scheme promotes dialogue, cooperation, and mutual understanding between the parties involved.

- The decisions reached through the scheme are legally binding and enforceable.

- The scheme offers a faster resolution process compared to the traditional court system.

- Confidentiality and privacy of the parties involved are maintained throughout the process.

- The scheme encourages a fair and impartial resolution of disputes.

- Both parties should approach the process with an open mind and a willingness to find a mutually agreeable solution.

- The scheme is designed to reduce the burden on the court system and promote access to justice for all.

- Any disputes or issues related to the scheme should be reported to the designated supervisory body.

Important Information

Some of the important information issued for the applicants are as follows:-

- Dealers must resolve any disputes regarding unpaid taxes, penalties, or interest before joining the waiver plan.

- Once a dealer submits an application or takes advantage of the program, they cannot file any additional appeals or applications with higher authorities or courts.

- The program cannot be used if the State has already appealed the case to specific authorities or courts.

- The program is not applicable if authorities have already started revising the case before October 31, 2023, or if any changes are made after this date.

Waiver Of Penalty & Interest For Assessments, Reassessments

With the help of this scheme, taxpayers can avail of a waiver of penalty and interest for assessments, reassessments, and other related matters. This implies that individuals and businesses who have pending tax dues can now settle their liabilities without incurring any additional charges. This move is aimed at reducing the financial burden on taxpayers.

Exceptions To Waiver Scheme For Certain Circumstances

In certain circumstances, the waiver may not be applicable. These exceptional circumstances include cases related to tax evasion, fraud, or intentional non-compliance. It is essential for taxpayers to understand that the scheme is designed to incentivize regular and honest taxpayers while ensuring that those who have deliberately evaded their tax obligations are not given the same benefits.

Waiver Of Interest & Penalty For Revision Orders

This provision allows taxpayers to rectify any errors or omissions in their tax returns or assessments without incurring additional charges. By encouraging taxpayers to voluntarily correct their mistakes, the government aims to promote transparency and accuracy in tax compliance. This provision serves as a significant incentive for individuals and businesses to rectify any unintentional mistakes made in their previous filings.

Remission Of Specific Penalties

This scheme will also offer the remission of specific penalties under the Karnataka Value Added Tax (KVAT) Act. This provision relieves taxpayers from certain penalties associated with non-compliance with the KVAT Act. By providing such relief, the government aims to encourage taxpayers to fulfill their tax obligations under the KVAT Act.

Karnataka Karasamadhana Scheme: 10 Benefits & Features

Here are its top 10 benefits and features:-

Benefits:-

- Waiver of Penalty and Interest: The scheme offers a 100% waiver of interest and penalty on outstanding tax dues, providing relief to taxpayers and encouraging them to settle their disputes.

- Flexible Payment Options: The scheme provides flexible payment options for taxpayers, including lump sum payment, installment payment, and payment through promissory notes.

- Time-Bound Settlement: The scheme provides a time-bound framework for resolving tax disputes, reducing uncertainty and delays for taxpayers.

- Reduced Litigation: The scheme aims to reduce litigation by encouraging taxpayers to settle their disputes through the one-time settlement window.

- Revenue Enhancement: The scheme can potentially enhance revenue collection for the state government by resolving pending tax disputes.

Features:-

- Applicability: The scheme is applicable to pending tax disputes under various state tax laws, including the Karnataka Sales Tax Act, Karnataka Value Added Tax Act, and Karnataka Central Sales Tax Act.

- Eligibility: Taxpayers with pending tax dues as of March 31, 2023, are eligible to avail the benefits of the scheme.

- Application Process: Taxpayers can apply for the scheme online or through the designated offices of the Commercial Taxes Department.

- Verification and Assessment: The Commercial Taxes Department will verify the applications and assess the outstanding tax dues.

- Settlement Agreement: Upon successful verification and assessment, a settlement agreement will be executed between the taxpayer and the Commercial Taxes Department.

Karnataka Karasamadhana Scheme Eligibility Criteria

The applicants will need to attain the below-mentioned points to apply online for this scheme:-

- The applicant must be a resident of Karnataka state.

- He or she must be a taxpayer.

- You must have taken a printout of your payment condition after submitting the payment.

- This printout copy must have been submitted to the Tax Department.

Important Documents

The applicants will need to affix the below-mentioned documents to apply online for this scheme:-

- Aadhar Card

- PAN Card

- Residence Certificate

- Business Card

- Bank Account Details

- Payment Proof

- Latest Passport Size Photograph

- Mobile No

- Email ID

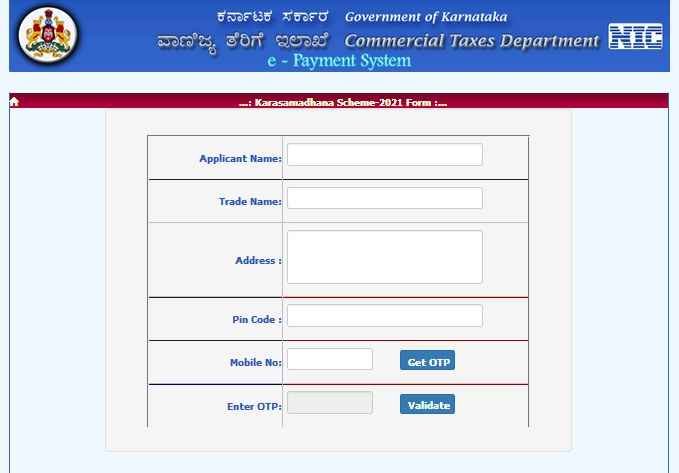

Karnataka Karasamadhana Scheme Apply Online

The applicants will need to follow the below-mentioned points to apply online for this scheme:-

- Visit and open the Official Website.

- Now you will get land on the main page of the site.

- The Registration Form will be there.

- Fill out each asked detail such as:-

- Applicant Name

- Trade Name

- Address

- Pin Code

- Mobile No

- Enter OTP

- Now click on the Validate Button.

- Then a new page will get displayed.

- Here you will need to click on the Reassessment Button.

- Read the details.

- Now enter the withdrawal date of the application.

Verifying e-Payment

The applicants will need to follow the below-mentioned points to verify e-payment:-

- The applicant will need to open the official website.

- On the homepage, click on the Verify e-Payment Button.

- A new page will get displayed where you will need to enter the asked details.

- Now click on the List button.

To Print e-Challan

The applicants will need to follow the below-mentioned points to print the e-Challan:-

- The applicant will need to open the official website.

- The homepage will get displayed on your screen.

- On the homepage, click on the Print e-Challan button.

- A new page will get displayed where you will need to enter the asked details such as:-

- CTD Ref.No( numeric only )

- TIN/RC ( numeric only )

- Payment Date( dd/mm/yyyy)

- Amount ( in Rs) ( decimal value )

- Now click on the Challan Print button.

e-Payment For Betting Tax

The applicants will need to follow the below-mentioned points to pay the betting tax:-

- The applicant will need to open the official website.

- The homepage will get displayed on your screen.

- Click on the link to Betting Tax.

- A new page will get displayed.

- Read the demanded details.

- Enter the asked details.

- Now click on the Next button.

- Then fill form step by step.

- In this way, you will be able to pay the betting tax.

Process To Pay KVAT

The applicants will need to follow the below-mentioned points to pay KVAT:-

- The applicant will need to open the official website.

- The homepage will get displayed on your screen.

- Click on the KVAT (Karnataka Value Added Tax) button.

- A new page will get displayed on your screen where you will need to enter some asked details.

- Enter the details and then click on the Next button.

- Then fill form step by step.

- In this way, you will be able to pay the KVAT tax.

E-Payment For CST

The applicants will need to follow the below-mentioned points to pay CST:-

- The applicant will need to open the official website.

- The homepage will get displayed on your screen.

- Click on the CST (Central Sales Tax) button.

- A new page will get displayed on your screen where you will need to enter some asked details.

- Enter the details and then click on the Next button.

- Then fill form step by step.

- In this way, you will be able to pay the CST.

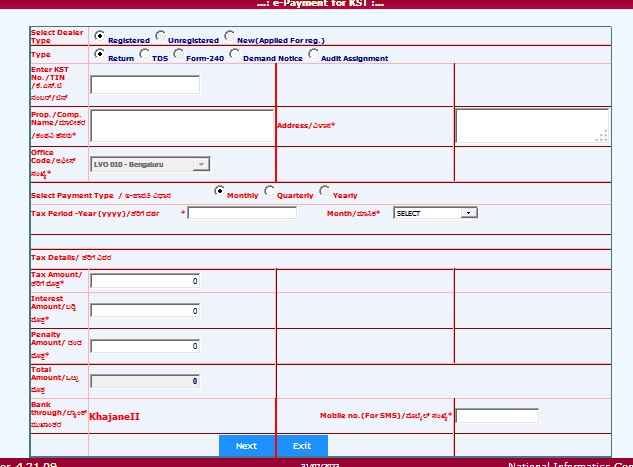

E-Payment For KST

The applicants will need to follow the below-mentioned points to pay KST:-

- The applicant will need to open the official website.

- The homepage will get displayed on your screen.

- Click on the KST (Karnataka Sales Tax) button.

- A new page will get displayed on your screen where you will need to enter some asked details.

- Enter the details and then click on the Next button.

- Then fill form step by step.

- In this way, you will be able to pay the KST.

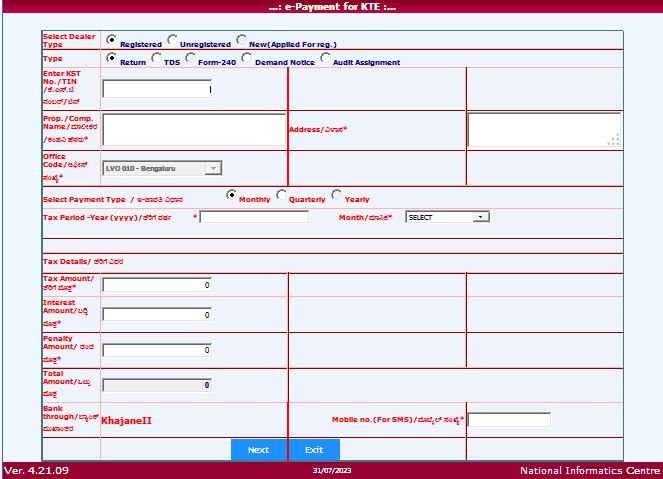

E-Payment For KTEG

The applicants will need to follow the below-mentioned points to pay KTEG:-

- The applicant will need to open the official website.

- The homepage will get displayed on your screen.

- Click on the KTEG (Karnataka Tax on Entry of Goods) button.

- A new page will get displayed on your screen where you will need to enter some asked details.

- Enter the details and then click on the Next button.

- Then fill form step by step.

- In this way, you will be able to pay the KTEG.

Contact Information

In case you are having any doubts or queries regarding the Karnataka Karasamadhana Scheme, then you may contact this mentioned toll-free no:- 18004256300.

Karnataka Karasamadhana Scheme : Top 10 FAQs

1. What is the Karnataka Karasamadhana Scheme?

The Karnataka Karasamadhana Scheme is a scheme introduced by the Karnataka government to provide a one-time relief to individuals or businesses who have outstanding dues towards various government departments.

2. Who is eligible to apply for the scheme?

Any individual or business entity with outstanding dues towards government departments in Karnataka is eligible to apply for the Karasamadhana Scheme.

3. What are the benefits of the Karasamadhana Scheme?

The main benefit of the scheme is that individuals or businesses can avail a waiver on interest and penalties on their outstanding dues, thus reducing the overall amount payable.

4. What types of dues are covered under the scheme?

The Karasamadhana Scheme covers various types of dues, including taxes, fees, fines, and penalties payable to government departments such as the revenue department, municipal corporations, electricity board, transport department, etc.

5. How can I apply for the scheme?

Applicants can apply for the Karasamadhana Scheme online through the official portal of the concerned government department or offline by visiting the respective department’s office.

6. What documents are required to apply for the scheme?

Applicants need to submit relevant documents such as proof of identity, proof of address, details of outstanding dues, etc., while applying for the Karasamadhana Scheme.

7. What is the deadline to apply for the scheme?

The deadline to apply for the Karasamadhana Scheme is usually announced by the government and may vary depending on the department and the specific dues.

8. Can I appeal if my application for the scheme is rejected?

Yes, applicants have the option to appeal the decision if their application for the Karasamadhana Scheme is rejected by the concerned government department.

9. Are there any conditions for availing the benefits of the scheme?

Yes, there may be certain conditions that applicants need to meet to avail the benefits of the Karasamadhana Scheme, such as timely payment of the reduced amount after waiver.

10. How will the scheme benefit the government departments?

The Karasamadhana Scheme is expected to help government departments recover outstanding dues in a timely manner and reduce the burden of pending payments on their financial resources.