Aasara Pension Scheme Apply Online & Application Form | Aasara Pension Scheme Check Amount & Last Date | Aasara Pension Scheme Check Features & Benefits | Aasara Pension Scheme Check Age Limit & Beneficiary Limitation | Aasara Pension Scheme Check Eligibility & All Details |

Now the applicants residing in the Telangana state will be able to get social economic welfare after getting an online registration offered under the Aasara Pension Scheme. The benefit of this scheme will only be provided to the candidates belonging to the categories of Old Age, Widow, Weavers, Toddy Tappers & Disabled Persons. Only the residents of Telangana state will be allowed to get an online registration for this scheme. Various benefits will be provided to them.

Through this article, we will provide you with all types of information about the Aasara Pension Scheme 2024 like purpose, Eligibility Criteria, Benefits, Features, important documents, etc. Apart from this, we will share with you the process to apply online for this scheme. To get complete information about this scheme, read this article till the end.

Aasara Pension Scheme

The State Government of Telangana has launched the Aasara Pension Scheme so that the residents belonging to the different categories of this scheme will be able to get some benefits. The applicants will be advised to apply online before the last date. The financial conditions of the beneficiaries of this scheme will get improved via this scheme.

Pension amounts of Rs. 1000/- to Rs. 3000/- will be provided to the Old Age, Widow, Weavers, Toddy Tappers & Disabled Persons. For this, they will need to apply online for the Aasara Pension Scheme. One can apply online before the last date. The amount of pension has now been increased from old rates to newer rates.

Highlights Of Aasara Pension Scheme

The highlights of this scheme are as follows:-

| Name Of The Scheme | Aasara Pension Scheme |

| Launched By | State Government of Telangana |

| Delegated State | Telangana |

| Delegated Ministry | Ministry of Electronics & Information Technology |

| Allocated Portal | Portal |

| Objective | To provide social security provisions to the applicants |

| Benefit | This will provide some financial stability to the underprivileged communities |

| Applicable To | Citizens of Telangana |

| Beneficiaries | Underprivileged Communities |

| Beneficiary Categories | Old Age, Widows, Weavers, Toddy Tappers & Disabled Persons |

| Age Limit | 18 to 65 Years |

| Form of Benefit | Pension Amount |

| Amount of Benefit | Rs. 2000/- to Rs. 3000/- |

| Transferal Basis | Monthly/Annual or One-Time Payment |

| Mode of Transfer | DBT |

| Hosting Site | National Information Center (NIC) |

| Mode Of Application | Online |

| Last Date of Online Form Submission | Will be updated soon |

| Office Address | Greater Warangal Municipal Corporation Beside MGM Hospital, Warangal:506002 |

| Call Center No | 0870 2500781 |

| Official Website | www.gwmc.gov.in |

Objectives of Aasara Pension Scheme

The major objective of launching the Aasara Pension Scheme is to provide financial help and support in the form of pension amounts to the disadvantaged communities of Telangana state so that the government will be able to provide them with the required help and support. This will make sure that the government is contributing some form of investment to the growth of its nation.

Another objective of launching the Aasara Pension Scheme is to provide the required help and support to the communities of this scheme so that they will be able to strive forward in their life after getting the pension amounts delivered to them. A target of covering around 24.21 lakhs of eligible beneficiaries has been set up or fixed by the selection body.

Beneficiary Category

This scheme will be provided to the below-mentioned beneficiaries:-

- Old Age

- Widow

- Weavers

- Toddy Tappers

- Disabled Person

Age Limit

It is also on the basis of the age limit that the applicants will be able to gain the benefits of this scheme. The applicants will need to make sure that they have attained the required age limit as per their beneficiary category. The age limit of the applicant must be between 18 years to 65 years.

Beneficiary Limitation

It is also on the basis of the target or beneficiary limitation that has been set up or fixed, the government will be able to reimburse the amount of pension among the eligible beneficiaries. According to the government guidelines, around 24.21 lakhs of beneficiaries will be shortlisted for getting the pension amounts for the stipulated amount of time.

Aasara Pension Scheme Last Date

Applicants can apply for this scheme by submitting an online registration form. The specific last date for form submission has not been announced yet. Once the selection body releases the final date, we will provide an update on this article. It is advised to patiently await the release of the last date for registration.

Old Rates of Aasara Pension Scheme

The old rates of this pension are as follows:-

| Beneficiary Category | Old Amount |

| Disable Persons | 1000 |

| Single Female | 1000 |

| Beedi Labourers | 1000 |

| Filaria Patients | 1000 |

| HIV Patients | 1000 |

| Old Age Pension | 1000 |

| Disabled Person | 1000 |

| Weavers | 1000 |

| Disabled | 1000 |

| Widows | 1000 |

Aasara Pension Scheme New Rates

The new rates of this scheme are as follows:-

| Beneficiary Category | Revised Amount |

| Disable Persons | 3000 |

| Single Female | 2000 |

| Beedi Labourers | 2000 |

| Filaria Patients | 2000 |

| HIV Patients | 2000 |

| Old Age Pension | 2000 |

| Disabled Person | 2000 |

| Weavers | 2000 |

| Disabled | 2000 |

| Widows | 2000 |

Aadhar Seeding Process

Aadhar seeding process will be carried out in order to link the mobile no with the appropriate aadhar no. of the applicant. In case, if the applicant has not linked his or her aadhar no then his or her aadhar no will get linked via this process. An attempt will be carried out to use the best fingerprint identification or error IRIS authentication.

Identification Process

In rural areas, the Gram Panchayat Secretary/Village Revenue Officer and in urban areas, the Bill Collector will accept pension applications. These officials verify and confirm the applications. The Mandal Parishad Development Officer/Municipal Commissioner/Deputy/Zonal Commissioner scrutinizes the applications and sanctions pensions based on set criteria. Data from household surveys and population figures, considering various social categories, are used for equity.

Implementation Process

All district collectors, CEO, and SERP are responsible for implementing the online scheme. Changes to the database or processes must follow strict protocols unless government instructions permit. Data security will be ensured. Only authorized alteration requests approved by authorities will be granted. The software vendor can make changes after receiving documented requests. Administrative costs of up to 3% can be used for TS Aasara pensions.

Pension Sanction & Card Issuance

The recommendation report will be evaluated and compared with the SKS survey data to identify the poorest individuals from all social categories. The verified data will be entered into the Aasara software and submitted to the district collector for final approval. Pension cards with the beneficiary’s photo will be distributed accordingly. The gram panchayat will maintain Register A and Register B, listing existing pensioners and eligible individuals not yet considered for the pension.

Pension Disbursement Release

At the state level, centralized acquaintances and proceedings will be generated in the software. The district collector’s approval will be sought through the web platform via the project director. After approval, the file will be uploaded to the Aasara software. SERP will generate the fund transfer report. MPDOs/tahsildars will download the acquittances, and give them to disbursing agencies, who will then distribute the pensions at the gram Panchayat level. Any changes in pensioners’ status will be reported monthly by the customer service provider, branch postmaster, gram panchayat, and secretary.

Pension Disbursement Process

Pensioners must have a bank account for pension remittance. In areas with ATM facilities, pensions will be directly deposited into beneficiaries’ bank accounts, accessible through their ATM cards. In rural regions, where banks or post offices exist, pensions will be disbursed via biometric authentication. Each pensioner must register in the biometric device. Disbursement will ideally occur in public places for convenience.

Benefits Of Aasara Pension Scheme

The benefits of this scheme are as follows:-

- The government will be able to provide the required help and support to underprivileged communities.

- This will alleviate the issues of poverty.

- It will provide safety nets for the beneficiaries during their worst times.

- There will be women empowerment.

- This will improve the living conditions of the beneficiaries.

- This scheme will bring transparency and accountability in the governance of this scheme.

Features Of Aasara Pension Scheme

The features of this scheme are as follows:-

- The State Government of Telangana has launched the Aasara Pension Scheme.

- The benefit of this scheme will be provided to the residents of Telangana state.

- Only the communities such as Old Age, Widow, Weavers, Toddy Tappers & Disabled Persons will be able to get the benefits of this scheme.

- An amount of Rs. 2000/- to Rs. 3000/- will be provided to the pensioners.

- The last date to apply online will be updated soon.

- One can visit the official website for more details.

Aasara Pension Scheme Eligibility Criteria

The applicants will need to secure the below-mentioned points to apply online for this scheme:-

- The applicant must be a resident of Telangana state.

- He or she must be an Old Age, Widow, Weavers, Toddy Tappers & Disabled Person falling under the age group of 18 years to 65 years.

- Landless agricultural laborers, rural artisans/craftsmen slum dwellers, and persons earning their livelihood on a daily basis in the informal sector like porters, coolies, rickshaw pullers, hand cart pullers, fruit/flower sellers, snake charmers, rag pickers, cobblers, destitute will also be given registration.

Important Documents

Some of the important documents required to apply for this scheme are as follows:-

- Aadhar Card

- Resident Certificate

- DOB Certificate

- Income Certificate

- Bank Account Details

- Husband Death Certificate ( In case of Widow)

- Latest Passport Size Photograph

- Registration of Cooperative society of Toddy Tappers Proof

- SADAREM Certificate in the case of persons with disabilities 40% or above and 51% in respect to the hearing impaired

- Post Office Saving Account

- Mobile Number

- Email ID

Aasara Pension Scheme Apply Online

The applicants will need to follow the below-mentioned points to apply online:-

- Visit and open the Official Website.

- Now you will get land on the homepage.

- On the homepage, look under the section Online Application.

- Click on the link to Pension Application.

- A new page will get displayed on your screen.

- Fill out each asked detail.

- Now the OTP will get sent to your mobile no.

- Enter the OTP.

- Then the application form will get displayed.

- Fill out the application form with the required details.

Track Application Status

The applicants will need to follow the below-mentioned points to track the application status of the Aasara Pension Scheme:-

- The applicant will need first to visit the official website.

- Now you will get land on the homepage.

- On the homepage, look under the section Online Application.

- Click on the link to Pension Application.

- A new page will get displayed on your screen.

- Now click on the link to Search Application Status.

- A new page will get displayed.

- Here, you will need to enter your Application Reference No. & Captcha Code.

- Then click on the Search Application Status Button.

To Do Login

The applicants will need to follow the below-mentioned points to do login:-

- The applicant will need first to visit the official website.

- Now you will get land on the homepage.

- On the homepage, look under the section Online Application.

- Click on the link to Pension Application.

- A new page will appear where you will need to click on the Login link.

- A new page will get displayed.

- Enter the login details such as:-

- Designation

- User Name

- Password

- Captcha

- Then click on the Login Button.

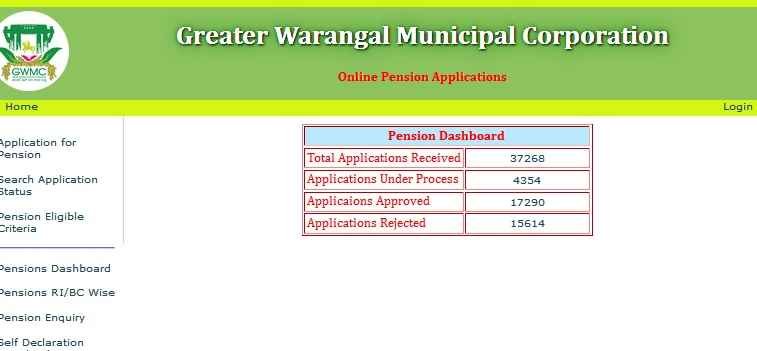

Viewing Dashboard

The applicants will need to follow the below-mentioned points to view the dashboard:-

- The applicant will need first to visit the official website.

- Now you will get land on the homepage.

- On the homepage, look under the section Online Application.

- Click on the link to Pension Application.

- A new page will appear where you will need to click on the Pensions Dashboard link.

- The dashboard will get displayed.

- See the details.

View Pensions RI/BC Wise

The applicants will need to follow the below-mentioned points to view RI/BC-wise details of this pension:-

- The applicant will need first to visit the official website.

- Now you will get land on the homepage.

- On the homepage, look under the section Online Application.

- Click on the link to the Pension Application.

- A new page will appear where you will need to click on the Pensions RI/BC Wise.

- A new page will appear where the information will get displayed in tabular form.

Do Pension Status Enquiry

The applicants will need to follow the below-mentioned points to do a pension status inquiry:-

- The applicant will need first to visit the official website.

- Now you will get land on the homepage.

- On the homepage, look under the section Online Application.

- Click on the link to the Pension Application.

- A new page will get displayed on your screen.

- Now click on the link to Pension Enquiry.

- A new page will be displayed where you will need to enter Enter House No (OR) Enter e-Aadhaar No.

- Now click on the Show button.

Getting Contact Details

The applicants will need to follow the below-mentioned points to get contact details:-

- The applicant will need first to visit the official website.

- Look at the top right-hand side corner of the screen.

- Now you will need to click on Contact Us.

- The contact details will get displayed on the screen.

Important Downloads

The links to important downloads are as follows:-

| Document or File | Link Provided |

| Self Declaration Form | Click Here |

| Eligibility Criteria | Click Here |

Contact Information

In case any queries and questions come to your mind regarding the Aasara Pension Scheme, then you may contact these mentioned-below office address and Call centre no:-

- Office Address:-

- Greater Warangal Municipal Corporation

- Beside MGM Hospital,

- Warangal:506002

- Call Center No:– 0870 2500781

Important Downloads

The links to important files are as follows:-

| File | Link Provided |

| Guidelines PDF | Click Here |