Telangana Crop Insurance Scheme Apply Online & Registration Form | Telangana Crop Insurance Scheme Check Premium Amount & Last Date | Telangana Crop Insurance Scheme Check Features & Benefits | Telangana Crop Insurance Scheme Check Notified Crops & Documents | Telangana Crop Insurance Scheme Check Eligibility & All Details |

The Telangana Crop Insurance Scheme, initiated by the State Government of Telangana, seeks to provide farmers with protection against crop failure. This scheme enables farmers to reduce or decrease the heavy losses caused by unexpected events and ensures continuity in their agricultural practices. Its primary goal is to safeguard farmers from unforeseen circumstances, allowing them to carry on with their agricultural activities smoothly.

Through this article, we will provide you with all types of information about the Telangana Crop Insurance Scheme 2024 like purpose, Eligibility Criteria, Benefits, Features, important documents, etc. Apart from this, we will share with you the process to apply online for this scheme. To get complete information about this scheme, read this article till the end.

Telangana Crop Insurance Scheme

Farmers must enroll in the Telangana Crop Insurance Scheme and pay a premium determined by the kind and quantity of their crops in order to receive benefits. Then, in the event that crop damage results from natural disasters like droughts, floods, pests, or illnesses, the government offers these farmers financial support.

To give farmers in the state financial security, the Telangana Chief Minister introduced the Telangana Crop Insurance Scheme. Farmers can get or receive crop insurance under this program in the event of crop failure or natural disasters. Farmers’ financial burden has been successfully decreased by the program, which has also guaranteed stability in this scheme.

Highlights of Telangana Crop Insurance Scheme

The highlights of this scheme are as follows:-

| Name Of The Scheme | Telangana Crop Insurance Scheme |

| Launched By | State Government of Telangana |

| Delegated State | Telangana |

| Delegated Ministry | Ministry of Electronics & Information Technology |

| Allocated Portal | Pmfby Portal |

| Objective | To provide insurance for crop failure to the farmers |

| Benefit | Farmers will be able to carry out farming in good conditions |

| Applicable To | Citizens of Telangana |

| Beneficiaries | Farmers |

| Form of Benefit | Crop Insurance Amount |

| Amount of Benefit | Variable |

| Transferal Basis | Monthly/Annual or One-Time Payment |

| Mode of Transfer | DBT |

| Hosting Site | National Information Center (NIC) |

| Mode Of Application | Online |

| Official Website | www.pmfby.gov.in |

Objectives Of Telangana Crop Insurance Scheme

The major objective of launching the Telangana Crop Insurance Scheme is to provide financial support to the farmers in Telangana in the event of crop damage or failure. This will ensure stability in the agricultural sector by protecting the farmers from financial uncertainties due to crop loss. Farmers can seek compensation for crop damage caused by natural calamities.

The second objective of the Telangana Crop Insurance Scheme is to promote sustainable agricultural practices. By providing insurance coverage, the scheme aims to encourage farmers to adopt modern technologies, and best farming practices, and use quality inputs in their agricultural activities. This objective also contributes to the overall development of the agricultural sector in Telangana by ensuring the use of efficient and sustainable farming methods.

Telangana Crop Insurance Scheme Beneficiary Category

It is only on the basis of the beneficiary category that the applicants or beneficiaries of this scheme will be able to avail the benefits of this scheme. The benefit of this scheme will only be awarded or provided to the shortlisted applicants. The benefits of this scheme will be provided to the farmers rearing their agricultural land living in Telangana state.

Notified Crops

The list of notified crops for this scheme is as follows:-

- Jangaon:- Cotton (Kapas), Red chilli

- Peddapalli:- Cotton (Kapas)

- Karimnagar:- Rice, Maize (Makka)

- Jagtial:- Cotton (Kapas), Red chilli

- Rajanna Siricilla:- Cotton (Kapas)

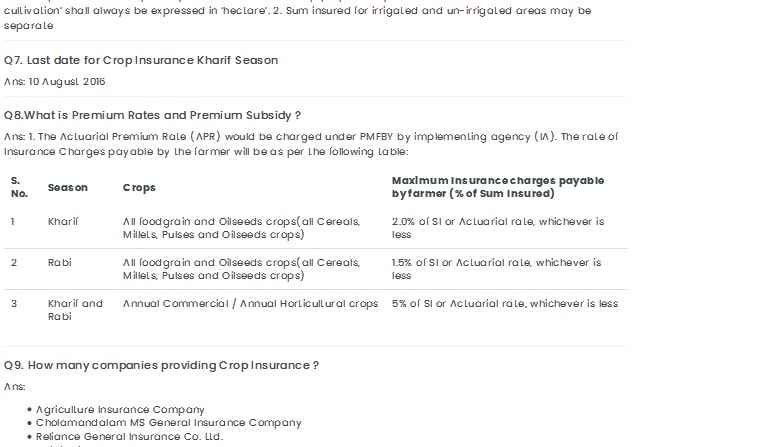

Minimum Subsidised Premium

The minimum subsidized premium amount for each crop type is as follows:-

| Crop Type | Minimum Subsidised Premium |

| Kharif Crops | 2% |

| Rabi Crops | 1.5% |

Government’s Reluctance to Implement Crop Insurance

The government believed there was no need to implement a scheme for insuring farmers’ crops because they made it voluntary. This would reduce the number of farmers who were insured. The government thought they already spent a lot of money on agriculture, so they didn’t want to spend more on this scheme. Farmers also wanted to be able to choose whether or not to join the scheme.

Failure to Release Premium Shares

In 2016-17 and the following year, a scheme in the State was successful. However, in 2018-19 and 2019-20, the State government did not release its share of the premium. As a result, the Centre also did not release its share, causing insurance companies to be unable to pay farmers’ claims totaling Rs. 960 crore. Both governments were supposed to share the premium amount, but they failed to do so.

Rain-Affected Farmers Receive Aid

Chief Minister K Chandrashekar Rao has decided to provide assistance to farmers affected by unseasonal rains. They will receive Rs 10,000 per acre for crop damage on 2.2 lakh acres. The government will also buy all damaged paddy at a fair price regardless of moisture content. The CM urged farmers to adjust their planting schedule to avoid future crop damage.

Devastating Rain Causes Massive Paddy Crop Loss in Telangana

Paddy crops in Telangana have suffered major losses this season due to heavy rain. The crops were grown on the highest-ever 53.7 lakh acres in the state. Many districts experienced damage to both standing crops and harvested yield. The government has assured farmers that they will purchase all the damaged crops. One farmer, Madhava Reddy, had invested Rs.3.5 lakh in his 12-acre paddy field but lost it all to rain and hail.

Issues in Crop Damage Compensation

Farmers in Adilabad, Vikarabad, and Yadadri-Bhongir districts faced problems getting their crop damage assessed and compensated. The Kisan Mitra Helpline and RSV activists have been working to address these issues, advocating for farmers and ensuring their names are covered for compensation. The government has not conducted damage enumeration since 2018, and there are concerns about transparency in the assessment criteria.

Telangana Government Neglects Crop Damage Compensation

Crop damage in Telangana has led to a long list of pending arrears. Around 15 lakh acres were damaged in Oct 2020, and another 11 lakh acres were affected by floods in July 2022. Despite petitions for compensation, the government has avoided taking responsibility. The State’s main focus is on the Rythu Bandhu scheme, leaving little funds for disaster relief.

Telangana Crop Insurance Scheme Deadline

It is obvious that the farmers will be able to get an online registration after applying online under this scholarship. For this, they will also need to get to know the last date by which they can get registration. The last date for online form submission has not yet been released by the selection body. Whenever it will get released, we will update you through this article till then you can wait for a moment.

Selection Procedure

The selection procedure for the Telangana Crop Insurance Scheme is as follows:-

- Farmers who are interested in availing the benefits of this scheme need to register themselves with the concerned authorities.

- Once registered, farmers need to provide details of their crops, land, and other relevant information.

- The authorities will then assess the eligibility of the farmers based on the provided information.

- Upon successful verification, the farmers will be enrolled in the scheme and will be eligible for insurance coverage.

Implementation Procedure

The implementation procedure of the Telangana Crop Insurance Scheme is as follows:-

- After the enrollment process, the farmers will need to pay a premium amount, which is a percentage of the sum insured.

- The premium amount can be paid online or through designated centers.

- Once the premium is paid, the insurance coverage will be activated.

- In case of crop damage due to natural calamities, the farmers need to inform the concerned authorities within a specified time frame.

- The authorities will then assess the extent of the crop damage and provide compensation accordingly.

Supervision Body

The Telangana Crop Insurance Scheme is supervised by a designated body that ensures the smooth functioning of the scheme. This body is responsible for:-

- Monitoring the enrollment process and verifying the eligibility of farmers.

- Ensuring the timely payment of premiums by the farmers.

- Overseeing the assessment of crop damage and the disbursement of compensation.

- Addressing any grievances or disputes related to the scheme.

Key Guidelines

Here are some key guidelines to be followed under the Telangana Crop Insurance Scheme:-

- The scheme is applicable only to farmers who have registered themselves and paid the premium amount.

- The insurance coverage is provided for specific crops as mentioned in the scheme guidelines.

- The compensation amount will be based on the extent of crop damage and the sum insured.

- Farmers need to inform the authorities about the crop damage within the specified time period to be eligible for compensation.

- The scheme provides coverage against natural calamities such as drought, flood, cyclone, etc.

- Farmers need to cooperate with the authorities during the assessment process and provide accurate information.

- The compensation amount will be directly credited to the bank account of the eligible farmers.

- Any false claims or misrepresentation of information can lead to the cancellation of the insurance coverage.

- Farmers can renew their insurance coverage on an annual basis.

- The scheme also provides financial assistance for the adoption of modern agricultural practices and technologies.

Important Instructions

Here are some important instructions to be followed by farmers under the Telangana Crop Insurance Scheme:-

- Ensure timely payment of the premium amount to avoid any lapse in insurance coverage.

- Keep all the necessary documents and records related to the crop and land details.

- Inform the authorities about any changes in the crop area or other relevant information.

- Follow the guidelines provided by the scheme authorities for the prevention and mitigation of crop damage.

- Report any discrepancies or issues faced during the enrollment or claim process to the designated authorities.

- Stay updated with the latest information and announcements regarding the scheme through official channels.

- Cooperate with the supervision body and provide accurate information during the assessment process.

- Utilize the financial assistance provided under the scheme for the improvement of agricultural practices.

- Seek guidance from agricultural experts or officials for any queries or clarifications related to the scheme.

- Ensure the proper utilization of the compensation amount for crop-related purposes.

Tips and Tricks

Here are some tips and tricks to make the most out of the Telangana Crop Insurance Scheme:-

- Understand the eligibility criteria and ensure that you fulfill all the requirements before enrolling in the scheme.

- Keep track of the premium payment dates and set reminders to avoid missing any deadlines.

- Maintain proper records of all the transactions and communications related to the scheme.

- Stay informed about the weather conditions and take necessary precautions to minimize crop damage.

- Explore other agricultural schemes and programs that can complement the benefits of the crop insurance scheme.

- Attend awareness programs and workshops organized by the scheme authorities to enhance your knowledge.

- Network with other farmers and share experiences and best practices for maximizing the benefits of the scheme.

- Seek advice from experienced farmers or agricultural professionals to optimize your crop management strategies.

- Regularly review and update your insurance coverage based on changes in your farming activities or land holdings.

- Stay proactive in reporting any crop damage to the authorities and follow the claim process diligently.

General Points to Remember

Here are some general points to remember about the Telangana Crop Insurance Scheme:-

- The scheme aims to provide financial protection to farmers against crop losses due to natural calamities.

- Proper registration and payment of premiums are essential for availing the benefits of the scheme.

- Timely reporting of crop damage and accurate information are crucial for claiming compensation.

- Follow the guidelines and instructions provided by the scheme authorities for a smooth process.

- Utilize the scheme’s financial assistance for the improvement of agricultural practices.

- Stay updated with the latest information and announcements regarding the scheme.

Benefits Of Telangana Crop Insurance Scheme

The benefits of this scheme are as follows:-

- Applicants will be able to carry out crop failure insurance.

- This will provide financial stability to the farmers.

- Farmers will not have to face crop failure issues.

- Minimum premium amounts will need to be paid by the farmers.

- One can apply online before the last date for getting timely registration.

- This will increase agricultural production.

Features Of Telangana Crop Insurance Scheme

The features of this scheme are as follows:-

- The State Government of Telangana has launched the Telangana Crop Insurance Scheme.

- The benefit of this farmer will only be provided to the Natives of Telangana state.

- Only farmers will be given crop insurance.

- Insurance will be provided for the selected crops.

- Only a 2% premium amount will need to be paid by the farmer for Kharif crops.

- For Rabi crops, the premium amount will be 1.5%.

Telangana Crop Insurance Scheme Eligibility Criteria

The applicants will need to attain the below-mentioned points to apply online for this scheme:-

- The applicant must be a resident of Telangana state.

- He or she must be a farmer.

- The farmer must be producing those crops that have been notified of this insurance scheme.

Important Documents

Some of the important documents required to apply online for this scheme are as follows:-

- Aadhaar Card (if applicable)

- Identification Proof (ID Proof)

- Address Proof

- Land Ownership Proof

- Land Revenue Records

- Crop Details

- Bank Account Details

- Photographs

- Income Proof (if applicable)

- Fertilizer and Pesticide purchase receipts

- Mobile No

- Email ID

Telangana Crop Insurance Scheme Apply Online

The applicants will need to follow the below-mentioned points to apply online for this scheme:-

- Visit and open the Official Website.

- Now you will get land on the homepage.

- Click on the Farmer Corner.

- A pop-up menu will get displayed on your screen.

- Look under Don’t have an Account? Section.

- Click on the Guest Farmer button.

- A registration form will get displayed.

- Fill out each asked detail such as:-

- Farmer Details

- Full Name

- Relationship

- Relative Name

- Mobile No.

- Age

- Caste Category

- Gender

- Farmer Type

- Farmer Category

- Residential Details

- State

- District

- Sub-District

- Residential Village/ Town

- Address

- Pin Code

- Farmer ID

- ID Type

- ID No

- Account Details

- Do you have IFSC

- IFSC

- State

- District

- Bank Name

- Bank Branch Name

- Savings Bank A/C No.

- Confirm Savings Bank A/C No.

- Farmer Details

- Enter the Captcha Code.

- Now click on the Create User Button.

- Your account will get created.

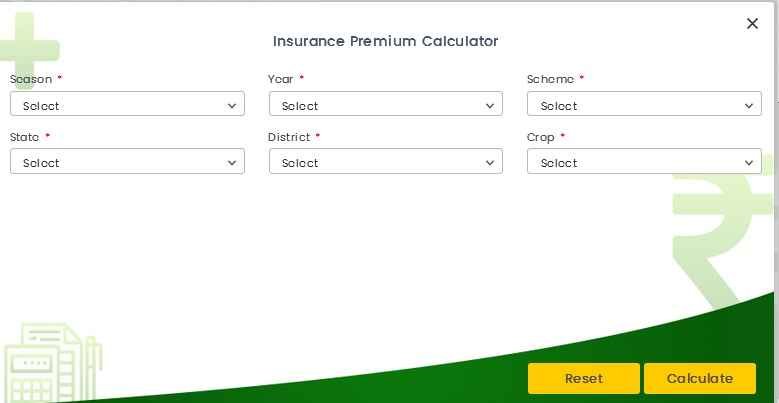

To Calculate Insurance Premium

The applicants will need to follow the below-mentioned points to calculate insurance premiums:-

- Visit and open the official website.

- On the homepage, click on the Calculate Corner.

- A pop-up menu will get displayed where you will need to enter the asked details such as:-

- Season

- Year

- Scheme

- State

- District

- Crop

- Now click on the Calculate button.

- The details will get displayed.

Tracking Application Status

The applicants will need to follow the below-mentioned points to track their application status:-

- Visit and open the official website.

- Now click on the Application Status link.

- A pop-up menu will be displayed where you will need to fill in the asked details.

- Then click on the Check Status button.

- The relevant details will get displayed.

Submitting Technical Grievance

The applicants will need to follow the below-mentioned points to submit technical grievances:-

- Visit and open the official website.

- Click on the Technical Grievance button.

- A form will get displayed.

- Fill out each asked detail such as:-

- Name

- Mobile

- Comments

- Now click on the Submit button.

Process To View Tenders

The applicants will need to follow the below-mentioned points to view tenders:-

- Visit and open the official website.

- Now you will get land on the homepage.

- Click on the Documents drop-down button.

- Then click on the Tender link.

- A new page will get displayed where the tenders will get displayed.

- Click on the relevant link to view more.

To Do CSC Login

The applicants will need to follow the below-mentioned points to do csc login:-

- Visit and open the official website.

- Now you will get land on the homepage.

- Then click on the CSC Drop Down button.

- Click on the CSC Login link.

- A new page will get displayed where you will need to enter your login details to do login.

- Now click on the Sign In button.

Finding CSC Center

The applicants will need to follow the below-mentioned points to find CSC Center:-

- Visit and open the official website.

- Now you will get land on the homepage.

- Then click on the CSC Drop Down button.

- Click on the CSC Locator.

- A new page will get displayed where you will need to enter the asked details.

- Click on the Search button.

- The relevant details will get displayed on your screen.

Viewing Gallery

The applicants will need to follow the below-mentioned points to view the gallery:-

- Visit and open the official website.

- On the homepage click on the Gallery.

- A new page will get displayed where the photographs will get seen.

- See as per your choice.

Reading FAQs

The applicants will need to follow the below-mentioned points to read the FAQs:-

- The applicant will need first to visit the official website.

- The homepage will get displayed on your screen.

- Scroll down the page until you will reach the bottom side of the page.

- Click on the FAQ link.

- The relevant details will get displayed.

Submitting Feedback

The applicants will need to follow the below-mentioned points to submit feedback:-

- The applicant will need first to visit the official website.

- The homepage will get displayed on your screen.

- Scroll down the page until you will reach the bottom side of the page.

- Click on the Feedback link.

- A feedback form will get displayed on your screen.

- Fill out this form with the correct details.

- Now click on the Submit button.