Stand Up India Scheme Apply Online & Registration Form & Check Amount, Last Date | Stand Up India Scheme Check Features & Benefits | Stand Up India Scheme Check Bank List & Borrower Types | Stand Up India Scheme Check Eligibility & All Details |

The Prime Minister of India Shri. Narendra Modi Ji has launched the Stand Up India Scheme so that the applicants belonging to the SC, ST and one woman will be able to start up their own enterprise in the greenfield after getting the loan amount awarded to them. This will empower the SC & ST communities to strive forward in their career. One can apply online for this scheme before the last date.

Today through this article we will provide you with all types of information about Stand Up India Scheme 2024 like Purpose, Eligibility Criteria, Benefits, Features, Important Documents, etc. Apart from this, we will share with you the process of applying online under this scheme. To get complete information about this scheme, read this article till the end.

Table of Contents

Stand Up India Scheme

The Central Government has launched the Stand Up India Scheme so that the government will be able to provide financial assistance to the marginalized sections of society who wish to establish their own ventures. The initiative offers various benefits such as loans, training, and consultancy services to individuals. This aims to promote entrepreneurship and create employment opportunities in India.

For promoting the entrepreneurial ecosystem so that the emergence of new enterprises will take place Stand Up India Scheme has been launched so that ST, SC, and one woman borrower will be able to get loans in order to build and establish their own business venture. With the help of this scheme, the new start-ups will get invested with the right and appropriate money. The applicants will be advised to apply online before the last date.

Highlights Of Stand Up India Scheme 2024

The highlights of this scheme are as follows:-

| Name Of The Scheme | Stand Up India Scheme |

| Launched By | PM of India Shri. Narendra Modi Ji |

| Delegated Ministry | Ministry of Electronics and Information Technology |

| Allotted Portal | Standupmitra Portal |

| Objective | To provide loan amounts to the new entrepreneurs to start their own businesses |

| Benefit | New entreprises will get established |

| Applicable to | Citizens of India |

| Beneficiaries | SC, ST and Women |

| Form of Benefit | Facilitation of Loan Amount |

| Amount of Loan | Rs. 15 Lakhs to Rs. 1 Crore |

| Host Site | NIC (National Information Centre) |

| Mode of Application | Online |

| Last Date To Apply Online | Will be updated soon |

| National Helpline Toll Free No | 1800-180-1111 |

| Email ID | support@standupmitra.in |

| Official Website | www.standupmitra.in |

Objectives Of Stand Up India Scheme

The major objective of launching the Stand Up India Scheme is to encourage the SC, ST, and Women communities to undertake their careers in entrepreneurial activities so that employment or job opportunities will get generated and the unemployment rates will get reduced. this will encourage entrepreneurship, job creation, and economic development in rural and urban areas.

Another objective of launching the Stand Up India Scheme is to provide financial help and support in the form of loan amounts so that the business ventures of the new entrepreneurs may get started and they will not need to face any kind of financial instability which is becoming a kind of hindrance that can be used for investing in their business purpose. This will promote sustainability among entrepreneurs.

Stand Up India Scheme Statistics

The statistics of this scheme are as follows:-

| Total Applications | 210605 |

| Sanctioned Applications | 189777 |

| Handbooking Agencies | 24613 |

| HHA Requests | 3366 |

| Lenders Onboarded | 83 |

| Branches Connected | 137882 |

Eligible Beneficiaries

The below-mentioned beneficiaries will be given an online registration:-

- SC Candidate

- ST Candidate

- Woman Candidate

Age Limit

The age limit will also be taken into consideration at the time of shortlisting the names of eligible beneficiaries who will be able to get an online registration for this scheme in order to avail of the benefits of this loan amount after getting selection. The applicant will need to make sure that his or her age limit must be above the age of 18 years.

Types Of Borrowers

There are 2 types of borrowers are as follows:-

- Ready Borrower

- Trainee Borrower

Loan Amount

The amount of loan that will be lent to the borrowers is as follows:-

| Minimum Loan Amount | Rs. 10,00,000/- |

| Maximum Loan Amount | Rs. 1 Crore or Above |

Stand Up India Scheme Achievements

The Stand-Up India Scheme has granted a total of Rs.40,710 crore to 180,636 accounts over the course of 7 years. This financing opportunity has provided countless individuals with the necessary support to start and grow their businesses, pushing the Indian economy forward. Through the scheme’s efforts, entrepreneurs have been able to access the capital needed to make their dreams a reality.

Stand UP Mitra Scheme Ecosystem

The following are some of the key components of the Stand UP Mitra Scheme ecosystem:

- Funding:- Loan amounts will be provided to the applicants at the subsidized rates.

- Mentoring:- Mentorship support will be provided to the aspiring entrepreneurs, helping them develop their business plans, identify potential markets for their products or services, and develop marketing strategies.

- Training:- Training assistance will be provided to the aspiring entrepreneurs, teaching them key skills such as financial management, marketing, and leadership.

- Networking:- This will also provide networking opportunities for entrepreneurs, allowing them to connect with potential customers, investors, and other business owners.

Stand Up India Scheme Last Date

It is obvious that the students will be able to get an online registration after applying online under this scholarship. The last date for online form submission has not yet been released by the selection body. Whenever it will get released, we will update you through this article till then you can wait for a moment.

Interest Rate Applicable

The Stand UP Mitra Scheme aims to provide easy access to credit at affordable interest rates but it doesn’t mean if the government is providing loans to borrow among the eligible beneficiaries then they will not charge any interest rate. The current interest rate for loans under this scheme is 7.95%, one of the lowest rates offered for small business loans in India.

Repayment Of Loan Amount

Repayment under the Stand UP Mitra Scheme is structured to provide ease and flexibility to the borrower so that the borrower will be able to easily repay the amount within the fixed duration. Individuals can choose to repay the loan within a tenure of up to 7 years. This allows entrepreneurs to chalk out sustainable repayment plans that match their revenue streams.

No Collateral Security

In some cases it is seen that when the applicant borrows a loan from any authorized unit he or she is liable to provide collateral security but in the case of the Stand UP Mitra Scheme, it has been designed to provide collateral-free loans. This means that entrepreneurs can avail of loans without putting up any collateral. This removes a significant barrier to accessing credit, especially for those who may not have adequate security to offer.

Margin Money

The Stand UP Mitra Scheme provides a working capital margin money of up to 25% of the loan amount sanctioned. This is provided to help entrepreneurs meet their initial expenses and cashflow requirements that are often critical to the success of their venture which will result in the successful formation of profits generated out of the sold products and services adding up value to the GDP of India.

Similar Schemes

Some of the similar schemes like this scheme are as follows:-

- Make in India

- Industrial Corridor

- Dedicated Freight Corridor

- Sagarmala

- Bharatmala

- UDAN-RCS

- Digital India

- BharatNet

- UMANG

- MUDRA Yojana

- Start-up India

- Pradhan Mantri Ujjwala Yojana

- Skill India

Stand Up India Scheme Empanelled Banks

The list of empanelled banks under this scheme are as follows:-

- Axis Bank

- Indian Bank

- Bank Of Baroda Indian

- Union Bank Of India

- Kashmir Bank Limited

- State Bank Of India

- Bank Of India

- Jammu Canara Bank

- IDBI Bank

- Bank Of Maharashtra

- UCO Bank

- Punjab & Sind Bank

- ICICI Bank

- PNB Bank

- Central Bank Of India

- Overseas Bank

Responsibilities of Stakeholders

The list of responsibilities of stakeholders are as follows:-

| Stakeholder | Responsibilities |

| Borrowers | Under this scheme, timely payments are mandatory for borrowers, including apprentices who will receive support throughout the process. Accessing the portal or bank branch requires answering specific questions and submitting all necessary documents. It is also necessary to share personal experience and participate in quarterly events centered around best practices. Setting up and efficiently running an enterprise is crucial to success under this scheme. Failure to comply with any of these requirements may result in consequences for the borrower. |

| Bank Branches | Efficient monitoring of performance is crucial for the smooth implementation of the scheme. To facilitate transparency, any grievances should be addressed at the bank level within 15 days. In addition, potential borrowers must be properly assisted in accessing the portal while all applications received, whether online or in person, must be processed. Timely loan delivery should be ensured, with rejected applications accompanied by the reason for such a decision. Overall, borrowers should be apprised of the situation and given all relevant information. |

| DLCC | At the district level, all complaints will be promptly resolved, ensuring satisfaction among all parties. In addition, a public utility service will be established to assist potential borrowers. Any work-related issues will be addressed and resolved effectively to ensure a smooth working environment. Progress will be regularly reviewed to ensure targets are being met and adjustments can be made where necessary. |

| LDM | To ensure the successful implementation of the scheme, it is essential to monitor its progress and organize timely meetings of the district level committee. Participation in events organized by NABARD with all stakeholders is also crucial for effective collaboration. Providing hand-holding support to borrowers and complying with relevant authorities are integral components of the process. Lastly, ensuring constant communication with bankers is critical to facilitating seamless execution. |

| Nabard | Regular events will be organized to share experiences among stakeholders, with a minimum frequency of once a quarter. The role also involves supporting the SLB and DLCC in their review and monitoring responsibilities, liaising with the bank for potential follow-up action, arranging handholding support and providing training to other stakeholders. Coordination with the LDM will also be a key aspect of this position. |

| SIDBI | As a member of NABARD’s programs, the individual is responsible for coordinating with the LDM and establishing communication with the bank for potential cases. Furthermore, they are accountable for arranging handholding support, managing and preserving the web portal effectively. It is their obligation to aid SLBC and DLCC in the monitoring and evaluation process, which contributes significantly to the success of the programs. |

Key Guidelines

Some key guidelines are as follows:-

- Eligibility Criteria: To qualify for the Stand Up India Scheme, the applicant must be a woman or belong to the SC/ST or OBC category.

- Loan Amount: Under this scheme, entrepreneurs can avail of loans ranging from Rs. 10 lakh to Rs. 1 crore to start or expand their business.

- Margin Money: The government provides up to 25% of the project cost as margin money, reducing the financial burden on the entrepreneur.

- Interest Rate: The interest rate for loans under the Stand Up India Scheme is competitive and favorable for budding entrepreneurs.

- Repayment Period: Entrepreneurs can repay the loan in easy installments over a period of 7 years, allowing for flexibility in managing finances.

- Project Cost: The loan amount can be utilized for various business activities, including manufacturing, services, or trading.

- Collateral-Free: The Stand Up India Scheme offers collateral-free loans, making it accessible to a wide range of entrepreneurs.

- Application Process: Interested applicants can apply online through the Stand Up India portal or visit designated bank branches for more information.

- Training and Support: The scheme also provides training and capacity building support to help entrepreneurs develop their business acumen.

- Monitoring and Evaluation: Regular monitoring and evaluation of the scheme ensure transparency and accountability in the disbursement of funds.

Important Instructions

Some important instructions are as follows:-

- Documentation: Ensure all necessary documents, such as ID proof, business plan, and bank details, are in order before applying for the scheme.

- Business Plan: A well-thought-out business plan showcasing the viability and sustainability of the project is crucial for approval.

- Compliance: Adhere to all government regulations and guidelines to avoid any legal issues or delays in the loan disbursement process.

- Financial Discipline: Maintain financial discipline and ensure timely repayment of the loan to build a good credit history.

- Networking: Build a strong network with other entrepreneurs, industry experts, and mentors for guidance and support.

- Market Research: Conduct thorough market research to identify potential customers, competitors, and growth opportunities for your business.

- Customer Focus: Prioritize customer satisfaction and feedback to improve your products or services and build a loyal customer base.

- Innovation: Stay updated on industry trends and incorporate innovation into your business model to stay ahead of the competition.

- Risk Management: Assess and mitigate potential risks to protect your business from unforeseen challenges or economic downturns.

- Continuous Learning: Invest in your professional development and skills enhancement to adapt to an ever-changing business landscape.

Tips and Tricks

Some tips and tricks are as follows:-

- Seek Mentorship: Find a mentor or advisor who can provide valuable insights and guidance based on their industry experience.

- Leverage Technology: Embrace digital tools and platforms to streamline operations, reach a wider audience, and enhance productivity.

- Marketing Strategies: Develop effective marketing strategies to promote your brand, attract customers, and increase sales.

- Financial Planning: Create a robust financial plan to manage expenses, track revenue, and ensure profitability in the long run.

- Diversification: Consider diversifying your product or service offerings to cater to different market segments and revenue streams.

- Customer Engagement: Build strong relationships with your customers through personalized interactions, loyalty programs, and feedback mechanisms.

- Team Building: Invest in building a skilled and motivated team to drive innovation, productivity, and growth within your organization.

- Adaptability: Be open to change and adapt to market dynamics, consumer preferences, and technological advancements for sustained success.

- Networking Events: Attend industry events, conferences, and trade fairs to expand your professional network and explore new business opportunities.

- Celebrate Milestones: Acknowledge and celebrate the milestones and achievements of your business to boost morale and motivation among your team.

General Points to Remember

Some general points to remember are as follows:-

- Stay Committed: Entrepreneurship requires dedication, perseverance, and resilience to overcome challenges and achieve success.

- Seek Feedback: Welcome constructive feedback from customers, mentors, and peers to identify areas for improvement and growth.

- Continuous Improvement: Strive for continuous improvement in your products, services, and operations to stay competitive and relevant in the market.

- Stay Informed: Stay updated on industry trends, market developments, and policy changes to make informed decisions for your business.

- Work-Life Balance: Maintain a healthy work-life balance to prevent burnout and nurture your overall well-being for sustained productivity.

- Stay Positive: Embrace a positive mindset, optimism, and a can-do attitude to navigate obstacles and achieve your entrepreneurial goals.

- Embrace Failure: View failures as learning opportunities, not setbacks, and use them to fuel your growth and resilience as an entrepreneur.

- Give Back: Contribute to society through social initiatives, community engagement, and ethical business practices to build a positive brand reputation.

- Network Effectively: Build meaningful relationships with industry peers, investors, and stakeholders to create mutually beneficial partnerships and collaborations.

- Celebrate Success: Take time to appreciate and celebrate your achievements, milestones, and victories as a testament to your hard work and dedication.

In conclusion, the Stand Up India Scheme provides a valuable opportunity for aspiring entrepreneurs to realize their business ambitions and contribute to India’s economic growth. By following the key guidelines, important instructions, tips and tricks, and general points to remember outlined above, you can navigate the entrepreneurial landscape with confidence, resilience, and determination. Are you ready to take the leap and stand up for your entrepreneurial dreams?

Meta Description: Explore the key guidelines, important instructions, tips and tricks, and general points to remember when applying for the Stand Up India Scheme to empower entrepreneurs in India. Stand Up India Scheme: Empowering Entrepreneurs for Success.

Benefits Of Stand Up India Scheme

The benefits of this scheme are as follows:-

- Financial Assistance: The Stand Up India Scheme offers loans ranging from Rs. 10 lakhs to Rs. 1 crore, making it easier for entrepreneurs to access the capital they need to start or expand their businesses.

- Lower Interest Rates: One of the key benefits of the scheme is the low interest rates on loans, which makes it more affordable for entrepreneurs to borrow money and invest in their ventures.

- Collateral-free Loans: Under the Stand Up India Scheme, women and SC/ST entrepreneurs can avail of collateral-free loans, reducing the financial risk associated with starting a business.

- Skill Development: The scheme also provides training and skill development programs to help entrepreneurs enhance their business acumen and succeed in their ventures.

- Marketing and Networking Support: Stand Up India offers marketing and networking support to help entrepreneurs promote their products and services and connect with potential clients and partners.

- Mentorship Programs: Entrepreneurs under the scheme can benefit from mentorship programs, where experienced business leaders provide guidance and advice on how to grow their enterprises.

- Government Subsidies: Stand Up India offers various government subsidies and incentives to support entrepreneurs and encourage them to invest in emerging sectors and industries.

- Ease of Application: The application process for the scheme is simple and streamlined, making it easier for entrepreneurs to access the financial assistance they need to kickstart their businesses.

- Customized Solutions: Stand Up India offers customized financial solutions tailored to the specific needs and requirements of each entrepreneur, ensuring they get the support they need to succeed.

- Empowerment and Inclusion: By supporting women and SC/ST entrepreneurs, the scheme promotes empowerment and inclusion, creating a more diverse and thriving business ecosystem in India.

Features Of Stand Up India Scheme

The features of this scheme are as follows:-

- The Pradhan Mantri Shri. Narendra Modi Ji has launched the Stand Up India Scheme.

- Eligibility Criteria: To be eligible for the Stand Up India Scheme, the entrepreneur must be a woman or belong to the SC/ST category and have a viable business plan.

- Loan Amount: Entrepreneurs can avail of loans ranging from Rs. 10 lakhs to Rs. 1 crore under the scheme, depending on the nature and scale of their business.

- Interest Rates: The scheme offers competitive interest rates on loans, making it more affordable for entrepreneurs to borrow money and invest in their ventures.

- Loan Repayment Period: Entrepreneurs can repay the loan over a period of up to 7 years, with flexible repayment options to suit their financial capabilities.

- Sector-specific Support: Stand Up India provides support and assistance to entrepreneurs in specific sectors and industries, helping them navigate challenges and seize opportunities for growth.

- Monitoring and Evaluation: The scheme includes monitoring and evaluation mechanisms to ensure that entrepreneurs are using the funds appropriately and achieving their business goals.

- Technology Integration: Stand Up India leverages technology to streamline the application and loan disbursal process, making it faster and more efficient for entrepreneurs to access funds.

- Linkages with Financial Institutions: The scheme has established linkages with various financial institutions and banks to facilitate the loan approval and disbursement process for entrepreneurs.

- Transparency and Accountability: Stand Up India operates with transparency and accountability, ensuring that funds are allocated and utilized in a responsible and efficient manner.

- Continuous Support: The scheme provides continuous support to entrepreneurs even after they have received the loan, offering guidance, training, and networking opportunities to help them grow and scale their businesses.

- For getting more information, one can visit the official website.

Stand Up India Scheme Eligibility Criteria

The applicants will need to follow the below-mentioned points to apply online:-

- The applicant must be an Indian citizen.

- He or she must be above 18 years of age.

- The beneficiary must be SC, ST and woman candidates.

- 51% shareholding and controlling stake should be held by SC, ST or women entrepreneurs in case of individual enterprise.

- He or she must be starting a business in the greenfield project.

Important Documents

Some of the important documents required to apply online under this scheme are as:-

- Aadhar Card

- Caste certificate

- Application Loan Form

- Permanent Residence Certificate

- Age Certificate

- Latest Passport Size Photograph

- Bank Account Details

- Mobile Number

- E mail ID

Process To Apply Online Under Stand Up India Scheme

The applicants will need to follow the below-mentioned points to apply online:-

- The applicant will need first to visit the Official Website.

- A homepage will be displayed.

- Scroll down the page.

- Look under the section You May Access To Loans.

- Click on the link to Apply Here.

- A new page will be displayed where you will need to enter your Name, Mobile no, and Email ID.

- Click on the Generate OTP button.

- The application form will be displayed on your screen where you will need to fill in the asked details.

- Now attach the relevant documents.

- Then click on the Submit button.

- In this way, you will be able to get an online registration.

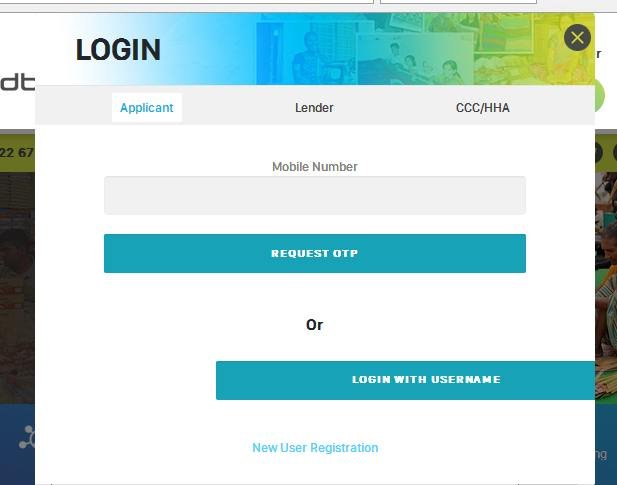

To Do Login

The applicants will need to follow the below-mentioned points to do login:-

- Visit the official website.

- Scroll down the page.

- Look under the section You May Access To Loans.

- Click on the link to Apply Here.

- Click on the Login link displayed at the top right hand side of the screen.

- The Login form will get displayed where you will need to enter the login details.

- Now click on the Login button.

Tracking Application Status

The applicants will need to follow the below-mentioned points to track application status under Stand Up India Scheme:-

- Visit the official website.

- Scroll down the page.

- Look under the section You May Access To Loans.

- Click on the link to Apply Here.

- Click on the Login link displayed at the top right hand side of the screen.

- The Login form will get displayed where you will need to enter the login details.

- After entering details, click on the Login button.

- Now click on the link to Application Status.

- A new page will get displayed where you will need to enter your “Reference Number”.

- Then click on the Submit button.

- The relevant details will get displayed on your screen.

Viewing Help Center Details

The applicants will need to follow the below-mentioned points to view details of help center:-

- Visit the official website.

- Click on the link to Help Centers.

- A new page will appear displaying relevant information in the tabular form.

- Go through the details.

Viewing LDM Details

The applicants will need to follow the below-mentioned points to view details of LDM:-

- Visit the official website.

- Now you will get land on the homepage.

- Click on the LDMs Link.

- A new page will appear displaying relevant information in the tabular form.

- Go through the details.

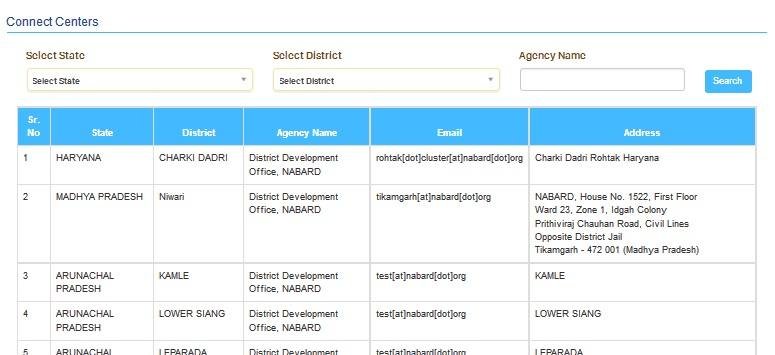

Viewing Connect Centers Details

The applicants will need to follow the below-mentioned points to view details of connect centers:-

- Visit the official website.

- Now you will get land on the homepage.

- Click on the link to Connect Centers.

- A new page will appear displaying relevant information in the tabular form.

- Go through the details.

Getting Contact Details

The applicants will need to follow the below-mentioned points to get contact details:-

- The applicant will need first to visit the official website.

- Scroll down the page until you will reach the bottom side of the screen.

- Now you will need to click on the Contact Us link.

- The contact details will get displayed on the screen.

Contact Information

In case you are having any doubts or queries regarding the Stand Up India Scheme, then you may contact this mentioned-below National helpline toll free no and email ID:-

- National Helpline Toll Free No:- 1800-180-1111

- Email ID:- support@standupmitra.in