Voluntary Retirement Scheme Apply Online & Application Form | Voluntary Retirement Scheme Check Compensation & Last Date | Voluntary Retirement Scheme Check Features & Benefits | Voluntary Retirement Scheme Check Age Limit & Years of Service | Voluntary Retirement Scheme Check Eligibility & All Details |

The Central Government has launched a Voluntary Retirement Scheme so that the employees working in the offices will be able to get retirement provided by the offices. This retirement will only be provided to the applicants as per their wishes which means if they want to get retirement then they can apply for this but if they don’t want to get retirement then they will not be forced so.

Today through this article we will provide you with all types of information about the Voluntary Retirement Scheme 2024 like purpose, Eligibility Criteria, Benefits, Features, and important documents, etc. Apart from this, we will share with you the process to apply online for this scheme. To get complete information about this scheme, read this article till the end.

Table of Contents

Voluntary Retirement Scheme

Sometimes the government offices or offices of any sector are not in a stable state or condition to grant the salaries of the employees working in the offices, in this case, the Voluntary Retirement Scheme has been launched recently by the government so that the government will terminate those employees for retirement who have attained the age above 40 years. This retirement will not be forcibly given to the employees to get retirement for the work.

Now the companies will be able to take control over the consumption of company costs and wages and will be able to reduce the strength of company size with the help of a scheme named Voluntary Retirement Scheme. The employees who have retired under this scheme will be given 45 days of salary for the full year.

Highlights Of Voluntary Retirement Scheme

The highlights of this scheme are as follows:-

| Name Of The Scheme | Voluntary Retirement Scheme |

| Launched By | Department Of Public Enterprises |

| Allotted Portal | dpe Portal |

| Delegated Ministry | Ministry of Electronics & Information Technology |

| Objective | To reduce the employee strength in the offices |

| Benefit | Employees will get compensation after retirement |

| Applicable To | Citizens of India |

| Beneficiaries | Employees |

| Beneficiary Category | Employees working in the public & private sector |

| Age Limit | 40 Years |

| Years of Service | 10 Years |

| Mode Of Transfer | DBT (Direct Benefit Transfer) |

| Payment Mechanism | e-payment mechanism |

| Form of Benefit | Sa;aru amount |

| Sa;aru Transferral | One-Time Payment Basis |

| Amount of benefit | Variable |

| Scholarship Tenure | 1 Year |

| Hosting Site | National Information Center (NIC) |

| Last Date To Apply Online | Will be updated soon |

| Mode Of Application | Online |

| Office Address | Department Of Public Enterprises Public Enterprises Bhawan, H6QM+8V6, Lodi Estate, CGO Complex, Lodi Colony, New Delhi, Delhi 110003 |

| Phone Number | 24362646 |

| Official Website | www.dpe.gov.in |

Objectives Of Voluntary Retirement Scheme

The major objective of launching the Voluntary Retirement Scheme is to reduce the strength of the workers working in the offices so that the offices who are not in stable condition will be able to reduce the consumption of infrastructure given to the employees for providing them salaries. This will put a reduction in the money used by the government for awarding salaries.

Another objective of launching the Voluntary Retirement Scheme is also to provide retirement to the employees working in the offices wanting to get or take retirement because they have attained that age limit in which the brain starts to become ageing and at this time, the brain of the employee need some relaxation that must be free from any kind of work such as office roles and responsibilities.

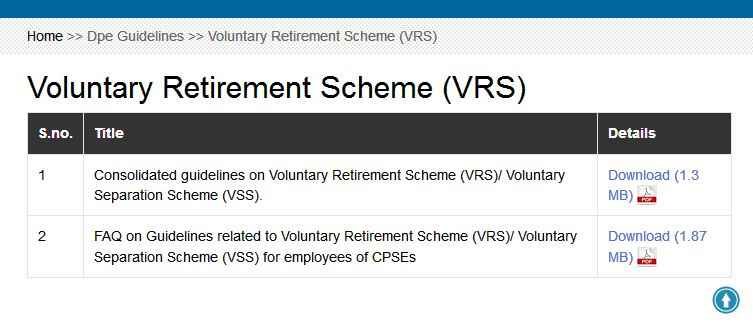

What is VRS?

This scheme has been launched with the active participation of the Department of Public Enterprises to reduce the workforce of the company so that they will be able to also reduce the money or expenses used for providing salaries to those employees. The company also doesn’t hold the right to appoint new employees in place of retired employees.

Beneficiary Category

The applicants will be able to get online registration for this scheme based on the beneficiary category that has been set up or fixed by the selection body. The applicant will need to make sure that he or she is an employee working in the public or private sector located within India.

Covered Sectors

There are 2 sectors covered as per follows:-

- Private Sector

- Public Sector

Maximum Age Limit

The age limit of the employee will also be taken into consideration at the time of shortlisting or nominating the names of employees who should be displayed in the list of those names in which the employees will be targeted to get retirement from their offices. The maximum age limit of the employee must be 40 years.

Years of Service

The employee must have carried out some years of service in the company in which they have been recruited to carry out their job responsibilities. Employees who have attained that year of service will be considered eligible. The employee must have done 10 years of service in the office work.

Offered Facilities

Some of the facilities that will be offered to the employees are as follows:-

- Rehabilitation Facilities

- Counselling Facility

- PF Fund

- Gratuity Dues

Compensation For Retirement

Applicants or employees who have been shortlisted for retirement from the company will also be liable to get compensation from the company based on some fixed duration or time. The employees will be given salaries equal to 3 months over a year in the form of compensation.

Applicable Conditions

This scheme will be applicable based on the below-mentioned conditions:-

- Obsolescence of Product or Technology

- Takeovers and Mergers

- Joint Ventures with Foreign Collaborations

- Recession in Business

- Intense Competition

Voluntary Retirement Scheme Last Date

The students will be able to get the registration after applying online under this scheme. For this, they will also need to get to know the last date by which they can get registration. The last date for online form submission has not yet been released by the selection body. Whenever it is released, we will update you through this article till then you can wait for a moment.

How does a Voluntary Retirement Scheme work?

Employees who wish to avail of the Voluntary Retirement Scheme need to submit an application expressing their desire to retire early. The company then evaluates the application based on certain criteria such as age, years of service, and cost implications. If the application is approved, the employee will receive retirement benefits as per the company’s policy.

Supervision Body

Before diving into the implementation procedure, it is essential to establish a supervision body. This body will oversee the entire VRS process, ensuring transparency and fairness. The supervision body should comprise representatives from various departments, including human resources, finance, and legal, to ensure a holistic approach.

Key Guidelines

Implementing a VRS requires careful planning and adherence to certain guidelines. Here are ten key guidelines to consider:-

- Clearly define the eligibility criteria for employees who can opt for the VRS.

- Ensure that the VRS package is attractive enough to encourage voluntary participation.

- Provide employees with a detailed explanation of the benefits and incentives associated with the VRS.

- Establish a transparent and unbiased selection process to avoid any discrimination.

- Communicate the VRS scheme effectively to all eligible employees, addressing any concerns or queries they may have.

- Set a clear timeline for the VRS process, including deadlines for application submission and acceptance.

- Ensure compliance with legal requirements and regulations governing VRS implementation.

- Offer support services, such as career counseling and job placement assistance, to employees opting for the VRS.

- Maintain confidentiality throughout the VRS process to protect the privacy of employees.

- Regularly evaluate the progress of the VRS and make necessary adjustments if required.

Important Instructions

While implementing a VRS, it is crucial to follow certain instructions to avoid any potential pitfalls. Here are ten important instructions to keep in mind:-

- Conduct a thorough analysis of the financial implications of the VRS on the organization.

- Ensure that the VRS is voluntary and not forced upon any employee.

- Provide adequate time for employees to consider the VRS offer and make an informed decision.

- Document all communications and agreements related to the VRS to maintain a record of the process.

- Train the supervision body on handling sensitive employee queries and concerns during the VRS implementation.

- Handle the exit process of employees opting for the VRS with sensitivity and professionalism.

- Keep the lines of communication open with employees throughout the VRS process.

- Ensure fairness and equity in the selection process, considering factors such as seniority and performance.

- Provide a grievance redressal mechanism for employees who may have concerns or complaints regarding the VRS.

- Conduct an evaluation of the VRS implementation to assess its effectiveness and make improvements for future reference.

Tips and Tricks

Implementing a VRS can be a complex task, but with the right tips and tricks, you can navigate the process smoothly. Here are ten tips and tricks to consider:-

- Seek expert advice or consult with professionals experienced in VRS implementation.

- Conduct a pilot run of the VRS process to identify any potential challenges or areas for improvement.

- Communicate the benefits of the VRS clearly and highlight the positive impact it can have on employees’ future prospects.

- Offer additional incentives, such as extended medical benefits or pension enhancements, to make the VRS more attractive.

- Provide employees with access to financial planning resources to help them make informed decisions.

- Consider offering training and upskilling opportunities to employees who opt for the VRS, enhancing their employability.

- Encourage open and transparent communication between employees and the supervision body throughout the VRS process.

- Regularly review and update the VRS policy to align with changing organizational needs and market trends.

- Recognize and appreciate the contributions of employees who opt for the VRS, ensuring a positive exit experience.

- Monitor the impact of the VRS on the organization’s overall performance and make necessary adjustments as required.

General Points to Remember

Finally, here are ten general points to remember when implementing a VRS:-

- Plan the VRS implementation well in advance to allow sufficient time for preparation.

- Ensure effective communication channels are in place to address employee queries and concerns.

- Consider the long-term implications of the VRS on the organization’s workforce and succession planning.

- Maintain confidentiality and handle employee data with utmost care and security.

- Monitor the psychological impact of the VRS on employees and provide necessary support.

- Encourage open and honest feedback from employees throughout the VRS process.

- Document the entire VRS implementation process for future reference and audit purposes.

- Comply with all legal requirements and regulations governing VRS implementation.

- Regularly evaluate the effectiveness of the VRS and make necessary adjustments.

- Celebrate the successful implementation of the VRS and acknowledge the contributions of all stakeholders involved.

Benefits Of Voluntary Retirement Scheme

The benefits of this scheme are as follows:-

- The applicants will be able to get compensation after retirement.

- The last age limit will be 40 years for the employees to retire.

- The employees who are going to retire will get 45 days of salary over a year.

- The applicants will not be forced to retire.

- One can apply online before the last date to get timely registration.

- This will provide them with the required relief from the work.

Features Of Voluntary Retirement Scheme

The features of this scheme are as follows:-

- The Central Government has launched the Voluntary Retirement Scheme.

- This scheme will be applicable all over India.

- This will work upon providing retirement.

- The main objective will be to reduce employee strength.

- The office authorities will be able to handle the finances at the time of providing salaries to the employees working in the office.

- For getting more information, one can visit the official website.

Voluntary Retirement Scheme Eligibility Criteria

The applicants will need to follow the below-mentioned points to get an online registration:-

- He or she must be an Indian Citizen.

- The applicant must be an employee working in the public or private sector.

- He or she must have contributed 10 years of minimum work.

- The minimum age limit must be 40 years.

Important Documents

Some of the important documents to apply online under this scholarship are as follows:-

- Aadhar Card

- PAN Card

- Income Certificate

- Attendance Proof

- Bank Account Details

- Email ID

- Mobile Number for receiving OTPs

- Proof of employee

Process To Apply Online Under Voluntary Retirement Scheme

As this scheme has been recently launched no such information has been released with the help of various social networking sites regarding the application procedure to apply online for the Voluntary Retirement Scheme. Whenever the application procedure is launched, we will update you through this article otherwise the applicant can visit the Official Website.

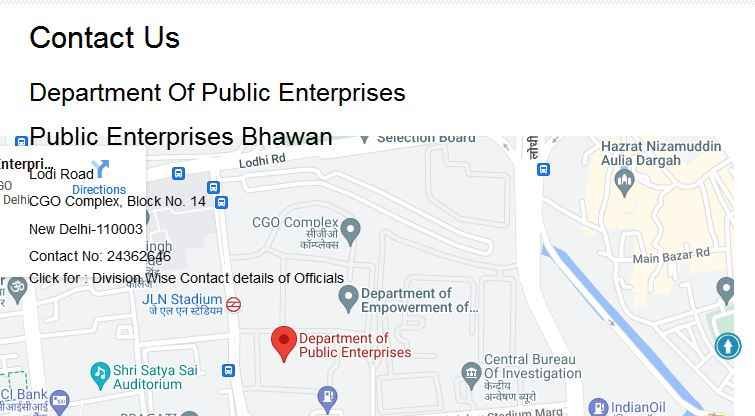

Getting Contact Details

The applicants will need to follow the below-mentioned points to get contact details:-

- Visit and open the official website.

- Now you will get land on the homepage.

- Scroll down the page until you reach the bottom side of the screen.

- On the homepage, click on the Contact Us option.

- Then, the contact details will be displayed on the screen.

Contact Information

In case any queries and questions come to your mind regarding the Voluntary Retirement Scheme, then you may contact this mentioned-below office address and phone number:-

- Office Address:-

- Department Of Public Enterprises

- Public Enterprises Bhawan,

- H6QM+8V6,

- Lodi Estate,

- CGO Complex,

- Lodi Colony,

- New Delhi,

- Delhi 110003

- Phone No:- 24362646